Indicators on Financial Advisor License You Should Know

Wiki Article

Facts About Financial Advisor Definition Revealed

Table of ContentsThe Best Guide To Advisor Financial ServicesFinancial Advisor Ratings Can Be Fun For EveryoneThe Greatest Guide To Financial Advisor RatingsA Biased View of Advisor Financial ServicesRumored Buzz on Financial Advisor Definition

You must likewise consider just how much cash you have. If you're searching for an expert to manage your cash or to assist you invest, you will certainly need to fulfill the expert's minimum account requirements. Minimums differ from consultant to consultant. Some might deal with you if you have just a couple of thousand dollars or much less.

You'll then have the ability to interview your suits to locate the best fit for you.

A Biased View of Financial Advisor Fees

Prior to conference with a consultant, it's a great suggestion to think of what kind of consultant you require. Beginning by thinking of your monetary scenario as well as goals. Advisors in some cases specialize to end up being specialists in a couple of facets of personal money, such as tax obligations or estate planning. If you're looking for certain guidance or solutions, consider what type of monetary advisor is a professional in that location.

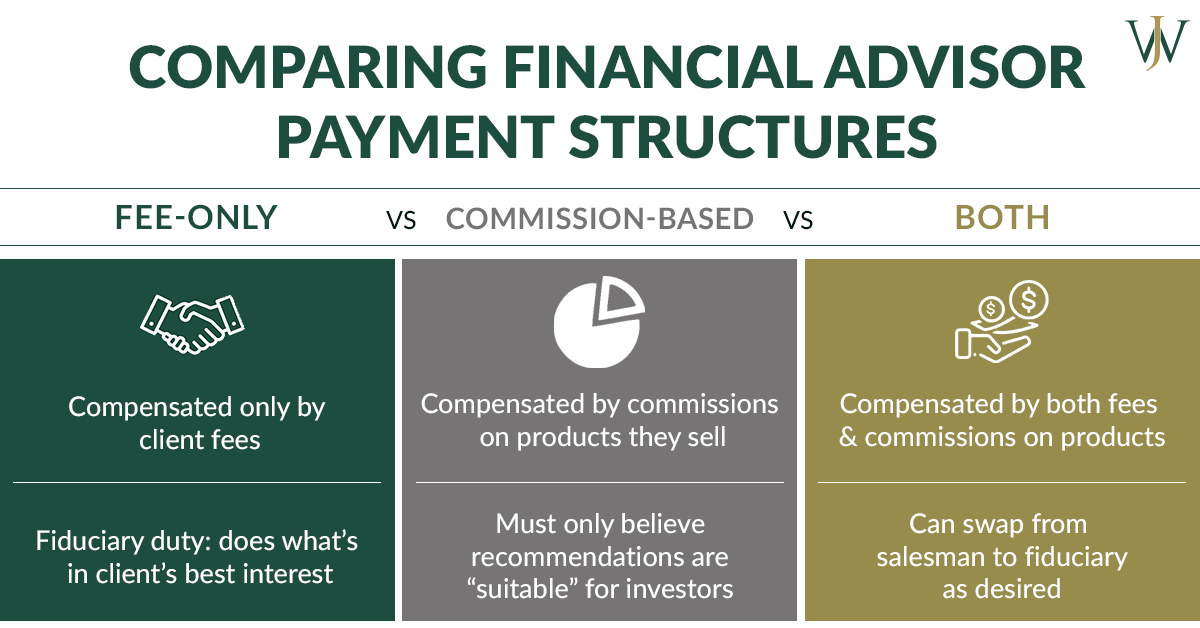

Which one should you deal with? We find that, by and also huge, individuals seeking economic advice recognize to search for a financial consultant that has high degrees of honesty and who desires to do what is in their clients' benefit in any way times. Yet it seems that fewer people pay attention to the orientation of their economic advisor candidates.

Not known Details About Financial Advisor Definition

Below's a check out 4 different kinds of consultants you are most likely to come across and exactly how they compare to each various other in some crucial areas. Armed with this information, you image source ought to be able to much better evaluate which kind is ideal fit for you based on elements such as your goals, the intricacy of your financial scenario and also your total assets.Financial investment consultant. Investment advisors are exceptional financial specialists who do a really good work handling moneybut that's all they do. While financial investment consultants offer a solitary solutionmoney managementthat one service can have several variants (from safeties to financial investments in personal firms, actual estate, art work and so forth).

In order to work as a economic consultant, one need to initially obtain the necessary education and learning by taking economic expert training courses. Financial consultants must have at the very least a bachelor's degree, and sometimes a master's is suggested. The most prominent majors for economic advisors are financing, business economics, audit, and also business.

Financial Advisor Salary for Dummies

Financial experts will certainly require this foundation when they are encouraging clients on reducing their dangers and conserving cash. When functioning as a monetary consultant, understanding why not try these out of financial investment preparation may show crucial when trying to design financial investment techniques for customers.There are some work in your life that you can deal with by yourself, and others that you leave to the pros. You possibly do easy auto repair work on your own, such as changing a headlight or an air filter, yet take the car to a technician for large work. When it concerns your financial resources, however, it can be trickier to determine which tasks are DIY.

There are all sort of economic pros available, with lots of various titles accounting professionals, stockbrokers, cash supervisors. It's not constantly clear what they do, or what sort of issues they're furnished to deal with. If you're really feeling out of your depth monetarily, your initial step needs to be to discover that all these various financial specialists are what they do, what they charge, and what options there are to hiring them.

Our Financial Advisor Jobs Ideas

1. Accountant The major factor the majority of individuals employ an accounting professional is to help them prepare and submit their tax obligation returns. An accounting professional can assist you: Submit your income tax return appropriately to stay clear of an audit, Find deductions you might be missing out on, such as a house office or child care reductionSubmit an extension on your tax obligations, Invest or give away to charities in means that will certainly decrease your taxes later on If you have an organization or are starting a side service, an accountant can do various other work for you as well.

Your accounting professional can also prepare economic declarations or reports., the typical cost to have an accounting professional submit Clicking Here your taxes varies from $159 for a straightforward return to $447 for one that consists of business revenue.

Report this wiki page